The stock market can have some extreme ups and downs at times, but you need to know the difference between a market correction and bear market in order to be ready when things happen. Here’s what you need to know about bear markets vs. market corrections.

What is a market correction in crypto?

A market correction is a temporary drop in prices of assets in a particular market. The most common corrections are in stocks, but they can happen in any asset class, including cryptocurrency. In general, a market correction happens when the prices of assets have risen too quickly and become overbought. This can happen for a variety of reasons, but usually it’s because investors are getting too optimistic about the future prospects of the asset or the underlying economy.

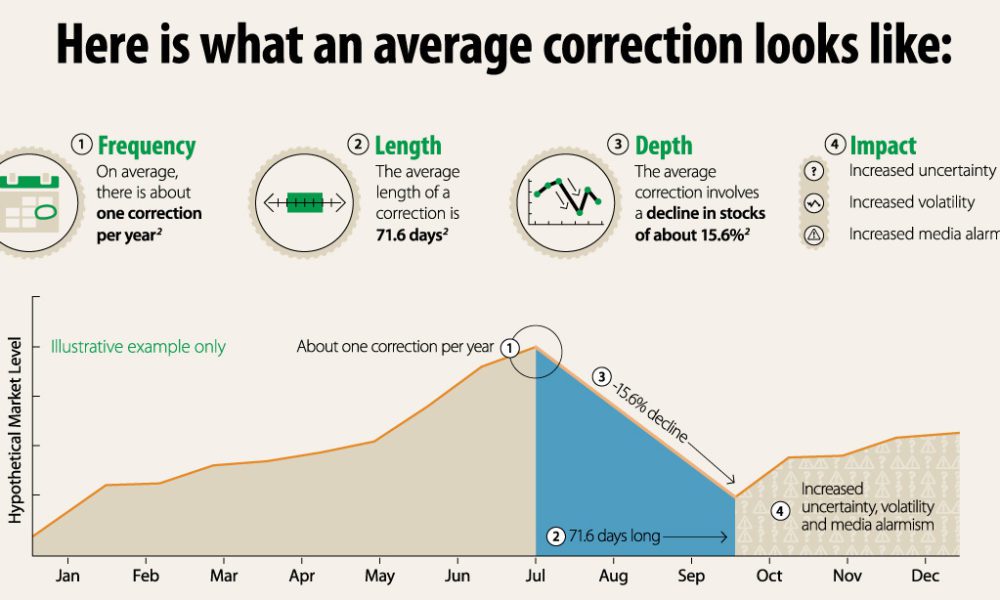

When markets have gone up quickly and are overbought or overvalued, it is known as a market correction. The result is a retreat from recent highs which the market uses to reset for another high. In most cases, a drop of 10% or more from recent highs is called a market correction. Nonetheless, 10% is not a hard-and-fast rule. Some corrections may be a drop of 3%. other cryptocurrencies might go up or down by 10% or more. In a growing economy, corrections occur when investors are too confident, so the market over-reaches, setting up a correction. Corrections are necessary to bring prices back to reality.

What causes market corrections in cryptocurrency?

There are a variety of factors that can cause market corrections in cryptocurrency. One is the overall health of the economy. When the economy is strong, investors are more likely to put their money into riskier assets like cryptocurrency. However, when the economy weakens, they tend to pull back and invest in more stable assets. Another factor is bear market history. Bear markets typically happen after a long period of growth, and they can be caused by a variety of factors including overvaluation, profit-taking, and fear.

Nevertheless, for new investors who are just learning about the existence of cryptocurrency, market corrections can be deeply unsettling. It may seem contradictory, but one must bear in mind that a market correction is not the same as a bear market. In fact, a market correction tends to happen during an existing bear market and is often considered better news than a new one. As people recall a bear market, they think back to 2008 and 2009 when Bitcoin had fallen from $16,200 on December 17th to $1,000 on November 30th.

Those were genuine bear markets because Bitcoin experienced losses and wasn’t able to regain them before going down again. When you compare that to what we’re seeing today–with Bitcoin going from $16k to almost $20k and then back down again in just a few months–this is just a correction, because Bitcoin is still going up in value. I’m not saying that just because prices fluctuate means you’re in a bear market.

What is a bear market in crypto?

A bear market is a period of time in which the crypto market experiences a significant drop in prices. This can be caused by a number of factors, including global economic conditions, government regulation, or even a major hack. A bear market typically lasts for several months, and can sometimes last for over a year. In contrast, a market correction is simply a short-term dip in prices that typically lasts for less than a month. Corrections are often caused by factors such as profit-taking or herd mentality. Unlike bear markets, corrections usually don’t have a lasting impact on the overall market.

In layman’s terms, a bear market is the prolonged drop in the market accompanied by fear, negativity, and skepticism. It is akin to a market correction, but this one lasts a much longer time. For a market to be classified as a bear market, prices must have fallen by 20% or more from recent highs. Just like market corrections, this figure can vary depending on market conditions. Market corrections occur when there is economic growth and a bear market is one that happens during a recession or a stock market crash. Any of the same factors that cause a market correction can also cause a bear market in crypto. Nevertheless, they can also be caused by other reasons, such as turmoil in the political scene or natural disasters.

How to build in a crypto bear market?

No one can predict the future of the markets with 100% accuracy, but by understanding bear market history, you can build a more accurate mental model for what to expect in a crypto bear market. Is it possible to profit from a bear market? Yes, of course. Likewise, just as there are strategies for investing in a bull market (period of rising prices), there are strategies for investing in a bear market (period of falling prices) too. One might choose a few of the following strategies:

Buying back an asset at a lower price after selling an asset without ownership to make a profit. In short-selling, there is no guarantee that the price will drop as expected. A call option is a financial instrument that lets the holder sell an asset to someone else for a specific price within a set period of time. The investor is entitled to the profit from the difference if the price of the asset falls below the strike price. Discounting assets: Investing is a long-term game, in general. The upside is that bear markets offer a discount to purchase assets during ups and downs.

When prices are falling, it is more important than ever to do your due diligence and research an asset thoroughly before making an investment. There will be many opportunities to purchase assets at a discount as prices decline. However, it is important to remember that not all assets are created equal. Diversify your portfolio: The best way to weather a bear market is to diversify your portfolio across different asset classes. That way, if one asset class is taking a hit, it won’t make a significant impact on your portfolio.

How to navigate corrections and bear markets?

Markets often experience bear markets, market corrections, and price volatility and when they do, panic may ensue. Once you understand the differences between bear markets, market corrections, and price volatility, navigating them will be much easier. Keeping a long-term outlook and disciplined investment strategy are the best ways to deal with a bear market. In addition, you could take more precautions with extra caution such as short-selling and put options.

As the economy appears to be expanding, most price declines will be temporary pullbacks or corrections. It’s important to remain invested in cryptocurrencies during these corrections. As primary trends tend to be bullish when the economy is growing, and with prices following suit by gradually moving to new highs, so it is with stocks, where price changes are rarely uniform or linear. Investment rallies are liable to be met by consolidations where prices in either direction remain steady or when markets correct themselves.

The risk of losing your investment portfolio is higher in bear markets, so it’s essential to know how to spot one before it happens. First, determine where the economy is. This way, you’ll know how to react when prices start to drop. Stay diversified and continue following your investment strategy even if you aren’t certain whether we are in a bear market. If the market crashes, you will be less likely to lose everything. Regardless of market conditions, when you follow your investment strategy, you will know when to buy and sell.

Market correction vs. bear market

A market correction is a temporary drop in stock prices of at least 10% from recent highs. A bear market is a prolonged decline in stock prices of 20% or more from recent highs. One of the key differences between the two is how long it takes. Bear markets can last for months or even years, while market corrections are typically over within weeks or a few months. Below is a summary of some of the main differences between the two: