You’ve probably heard of retail banking, but what exactly does it mean? Is it something you should be thinking about if you work in the business world? The answer to that question depends on your specific work and career goals, so let’s look at some of the differences between retail banking and corporate banking to help you figure out which one could be right for you.

The difference between Retail Banking and Corporate Banking

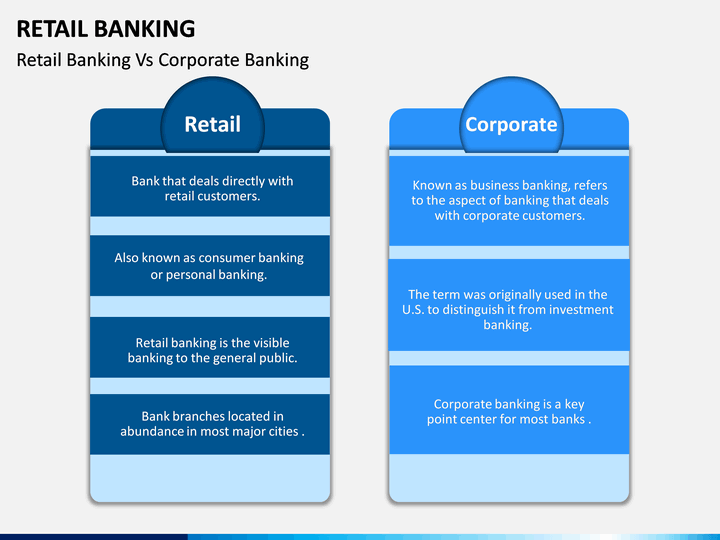

Retail banking is the typical banking most people are familiar with, where individuals open checking and savings accounts and take out loans. Corporate banking, on the other hand, is geared towards businesses. Services offered may include deposits, loans, and cash management services. The main difference between the two is that corporate banks typically offer more specialized services than retail banks. Depending on what type of business you have, this can be a huge benefit or a major drawback. For example, if you’re in construction you may need access to funds at any time during the project- often before your deposits come in- and not just for emergencies.

Corporate banking is also excellent if you want or need specialized services, like travel and entertainment expense account management or a company credit card with multiple employees on it. If you’ve taken out a loan from a retail bank before and found yourself working with multiple people that weren’t helpful and unresponsive, corporate banking might be more to your liking as they have employees who specialize in each area of their business so they’re better equipped to handle problems that arise in a timely manner. Corporate banks are also typically more flexible when it comes to loan applications and repayment schedules. This can mean better terms for you, even if you don’t end up going with them!

How do you know which one is right for you?

There are a few key things to consider when trying to decide whether corporate or retail banking is right for you. First, think about the size of the businesses you want to work with. If you’re interested in working with small businesses, then retail banking might be a better fit. However, if you’re interested in working with large businesses, then corporate banking might be a better option. Second, consider the type of relationship you want to have with your clients. Corporate bankers typically have more of a consultative relationship with their clients, while retail bankers typically have more of a transactional relationship. Finally, think about your career goals and what kind of environment you want to work in. If you’re looking for stability and predictability, then corporate banking might be a good fit.

After taking into account these factors, you should be able to make a more informed decision about which type of banking is right for you. If retail banking feels like a better fit, then that’s okay too! Whichever one you choose will give you valuable insight into both corporate and small business operations, so either option can help prepare you for your future career in finance. When deciding between corporate and retail banking, consider your interests and goals to find an environment that fits your needs and personality while helping you grow as a professional in today’s fast-paced financial world. Choosing wisely will get you off on the right foot with valuable experience to take with you as your pursue further financial success.

Considerations before taking a job in retail or corporate banking

Before you take a job in retail or corporate banking, it’s important to understand the key differences between the two types of banking. Retail banking is focused on individual customers, while corporate banking is focused on businesses. Corporate bankers may work with large businesses that have complex financial needs, while retail bankers typically work with smaller businesses and individuals. If you’re interested in a career in banking, it’s important to understand the different types of banking and decide which one is right for you.

Both retail and corporate banking are rewarding and lucrative careers that offer valuable opportunities to develop your career in finance. A career in corporate banking might be more satisfying if you have a passion for business, while retail banking could be a better fit if you’re interested in working with customers on a regular basis or want to climb up to management positions quickly. The one-size-fits-all answer is that retail banking pays less but has higher job satisfaction, while corporate banking pays more but often offers less personal satisfaction. For many people, finding a balance between compensation and fulfillment is just what they’re looking for in their career path.

The best places to look for corporate and retail banking jobs

Corporate banking is a great place to start if you’re interested in working in the finance industry. The work is fast-paced and challenging, and you’ll get to work with clients of all sizes. Retail banking is a good option if you’re interested in working with the public and providing customer service. You’ll also get to work with a variety of products and services, and you’ll have the opportunity to build relationships with clients.

There are a variety of places to look for jobs in both corporate and retail banking, but don’t feel limited by these options! Check job boards like Monster or Indeed for job postings, and get to know local financial institutions to see if they have any openings available. Networking is another excellent way to find a job in banking, so make sure you talk with people about your career goals and reach out when you’re looking for new opportunities. Remember that every finance-related role counts as experience on your resume; even entry-level jobs can be helpful if they highlight relevant skills or let you build relationships with coworkers who may be able to offer insights into other employment possibilities down the road.

To retail, or to corporate banking—that is the question!

/shutterstock_35222761-5bfc4783c9e77c00587d5e8c.jpg)

For the uninitiated, the world of banking can be pretty confusing. There are all sorts of different terms and acronyms flying around, and it can be tough to know what they all mean. Today, we’re here to help clear things up a bit. We’re going to explain the difference between retail banking and corporate banking, and hopefully by the end of this post you’ll have a better idea of which one is right for you.

At its most basic level, retail banking is what you probably think of when you imagine a bank; it’s where regular people go to do their everyday banking needs—depositing checks, taking out loans and so on. Corporate banking is typically only relevant to businesses, but it’s still important to know about even if you aren’t currently operating your own company. It provides many of the same services as retail banking, including checking accounts and loan accounts, but it’s all tailored to businesses rather than individuals. For example, corporate customers can deposit payroll checks with their corporate checking account or obtain lines of credit that are backed by inventory or other assets that they keep at their corporate bank.