First things first: the bank statement! Your bank statement tells you exactly how much money you have in your bank account (most of the time) and can come in handy when you’re trying to figure out exactly how much money you have left over after buying groceries or paying rent. But that’s not all it does; in fact, your bank statement has lots of hidden treasures waiting to be found by someone who knows how to decipher what it’s saying. Here are some tips for reading your bank statement like a pro!

Overview

A bank statement is a document that shows all the transactions made through your account with a financial institution. This usually includes deposits, withdrawals, fees, and interest earned. To read your bank statement like a pro, start by looking at the summary section. This will give you an overview of your account activity for the month. Then, take a closer look at each transaction listed. Note the date, amount, and type of transaction. If anything looks suspicious, be sure to contact your bank right away. Finally, compare your bank statement with any records you may have of your own transactions. This will help you catch any errors that may have been made.

Also, as with all documents, it’s important to check your bank statement for any inconsistencies. For example, if you have a standing deposit of $100 per month, you would expect that amount to be withdrawn from your account each month without fail. If you see any missing payments or deposits or other oddities in your bank statement or records, speak with your financial institution right away. Most importantly, never ignore anything suspicious when it comes to money! A bank statement is an overview of money activity in and out of your account; it’s not meant as a record of what you did with every dollar spent and earned during a period.

Balance and Available Funds

The first thing you’ll want to do when you open up your bank statement is locate the balance and available funds. This will give you an idea of how much money you have in your account and how much you can spend. Keep in mind, however, that the balance may not reflect all of the money that’s available to you. Some financial institutions may hold onto funds for a period of time before making them available, so be sure to check the available funds as well.

The available funds, on the other hand, are reserved for you to spend. You may also see it as your available balance or cash balance. This is money that has been set aside by your bank and is no longer available for withdrawal unless you specifically request it. For example, some banks will hold deposits of cash checks (such as those from your paycheck) in order to process them later—this amount will show up as a held check on your bank statement and can be released at any time if you need it back. It’s important to know where your money is going so that you don’t accidentally spend something that’s intended for another purpose!

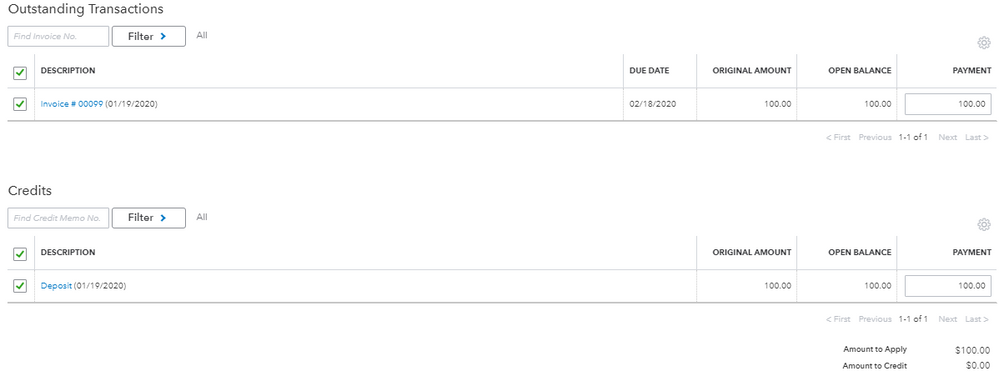

Deposits, Credits, and Payments

The first section of your bank statement will show all of the deposits, credits, and payments that have posted to your account during the statement period. These are typically listed in chronological order. To get a better understanding of this section, let’s take a look at each type of transaction:

- Deposits are money that is added to your account, such as your paycheck or money from selling something.

- Credits are money that is taken out of your account, such as when you use your debit card or make an online payment.

- Payments are money that you’ve transferred out of your account, such as when you pay your rent or make a purchase with your credit card.

Debit cards and checks can also trigger deposits, credits, or payments. Debit card transactions will usually show up as debit on your statement, while check transactions are typically labeled check.

Once you’ve established what kind of transaction posted to your account and when it posted, follow these steps: Match each deposit, credit or payment with an expense category on your budget by using the date and amount information listed on your bank statement. If you have trouble locating an expense category that matches with one of your withdrawals or transfers from savings, don’t worry – there’s still one more place where you’ll find an explanation for that transaction: inside your register!

Fees and Charges

![]()

The first section of your bank statement is typically devoted to fees and charges. This is where you’ll find information on things like monthly service fees, ATM fees, and any other charges that may have been applied to your account. It’s important to understand what each of these fees are for so that you can avoid them in the future.

You’ll usually find that many banks charge monthly fees for holding an account. In some cases, you can avoid these fees by maintaining a minimum balance or having your salary paid directly into your account. Other fees may not be avoidable, but it’s worth asking about them before committing to anything. For example, do you really need overdraft protection? It’s important that you take action if there are too many charges being applied to your account and you don’t understand why they’re there or what they’re for. Otherwise, it could come back to bite you later.

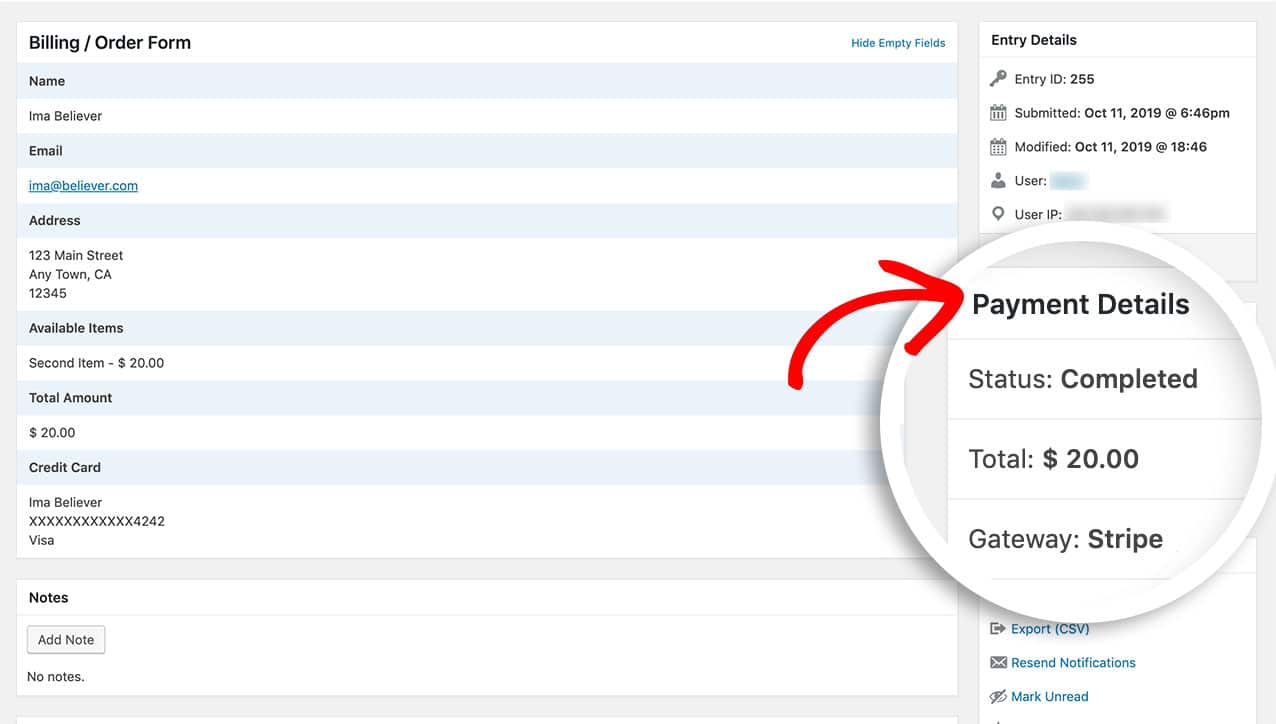

Transaction Details

Knowing how to read your bank statement is important for keeping track of your spending and making sure there are no fraudulent charges. The transaction details section lists all of the transactions that have posted to your account during the statement period, along with the date, amount, and type of each transaction. Here’s how to read this important information:

- Look at the date of each transaction. This will help you identify when the purchase was made or when the payment was received.

- Check the amount of each transaction. This will help you keep track of your spending and make sure all charges are accurate.

- Note the type of each transaction. This will help you see what kind of purchases you’re making and whether or not they are necessary.

- Compare your balance from your last statement. This will help you see how much money you’ve received and spent since your last statement. If there is a big difference between your two statements, you may want to investigate why so much money has been added or subtracted from your account.

Remember that regular income—such as rent, wages, interest, and dividends—will be added throughout the month instead of on one day, while irregular income—such as bonuses or reimbursements—will likely show up in one lump sum. Any unexpected charges should be investigated immediately as fraud or theft could have occurred on your account.